By Ishan Sinha

In December, I wrote about how media companies may view new technological advancements, especially AI, as a threat rather than an opportunity. And how they may have good reason to do so: from lawsuits over training data to platforms that undermine IP value, the entertainment industry has been put on the defensive.

But I also made the case that there’s another path: one where tech can help media companies monetize their content more effectively, and where AI is used to expand the value of IP, not exploit it.

I believe Fever is one of those companies.

Founded in 2014, Fever is a global live entertainment discovery platform that uses AI and behavioral data to help people find immersive, real-world experiences — with the goal of helping creators, producers, and IP holders fill more seats, earn more revenue, and reach more fans. Their tech stack is built around a data-driven engine that is designed not only to personalize recommendations for consumers, but also to help optimize pricing, forecast demand, and unlock incremental revenue.

I believe this approach is an example of the type of alignment between tech and media I discussed in my post in December. We do not view Fever as trying to outsmart the entertainment ecosystem; we believe it’s enabling it. Fever’s technology is specifically focused on discovery, distribution, and monetization and is set up to work with content owners, rather than around them.

For consumers, Fever is working to use AI to personalize event recommendations, helping them find new experiences beyond the usual concerts or Broadway blockbusters. For organizers, enhanced customer discovery tools could offer the chance to reach targeted audiences and optimize performance — two pain points we believe are persistent in the live events space.

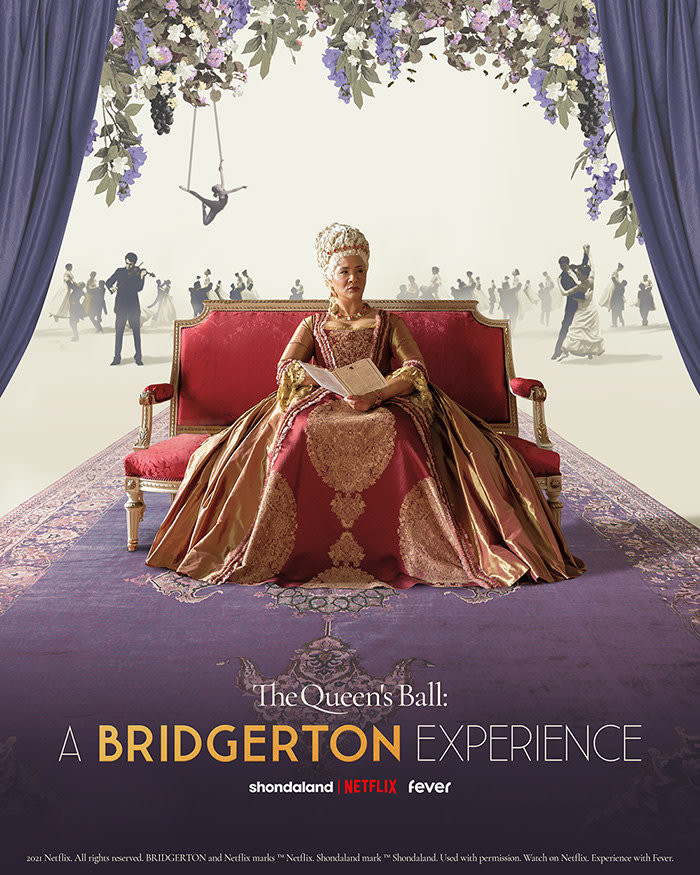

But what makes Fever especially exciting to us is what they have been able to do with IP. Through their Fever Originals initiative, they partner with rights holders to develop exclusive, immersive events based on beloved properties from Bridgerton and Stranger Things to Van Gogh and Squid Game. These are more than just themed nights out; we believe they’re new ways to monetize content libraries, deepen fan engagement, and extend the life of creative work.

Image: Fever

In my opinion, the real bottleneck in today’s entertainment landscape isn’t production, it’s discovery. We already have access to more content than anyone could reasonably consume. As of 2023, it would take 36,667 hours or four years, two months, and eight days of nonstop viewing — to watch everything available on Netflix. For context, the average user only gets through about 2% of their Netflix library each year. Instead, I think the real challenge is distribution: how do you get the right content in front of the right audiences, at the right time? Fever’s model is targeting that directly, both through personalized recommendations and a broader tech-enabled approach to live event marketing.

At Point72 Private Investments, we believe in backing companies that are rethinking entertainment in ways that work with creators and content owners. Our early investments in Mirror as well as Range Media reflected that belief and our recent investment in Fever is a continuation of that strategy.

We see Fever as a critical piece of the next era of the experience economy — one where AI enables smarter, more personalized entertainment without compromising the creative integrity that makes it all worthwhile.

We’re excited to support Ignacio, Alex, Francisco, and the rest of the Fever team as they continue to build a platform that brings people closer to the experiences they love and helps creators and IP owners reach new audiences in meaningful ways.

Perspectives

October 28th, 2024

Clunky copilot or benevolent boss? Why I believe AI should prompt us

December 14th, 2023

Testing Built for AI Software: Our Investment in Distributional

October 24th, 2023

Making Cultural Values Stick – A Guide for Start-Up Founders

February 12th, 2021