Gaming – The Next Big Opportunity in Fintech?

“Video games are bad for you? That’s what they said about rock-n-roll.” – Shigeru Miyamoto

If you were asked to envision the stereotypical video gamer, what would you see? Most likely a teenager, perhaps no more than 17 years old, with no real-life responsibilities, whiling away the hours late into the night in virtual worlds. The fictional character you’re imagining also wouldn’t be concerned with financial technology or see themselves as an important actor in the global fintech ecosystem. If this is what you’re imagining, the reality of the typical gamer might surprise you.

Video Games: The King of Entertainment

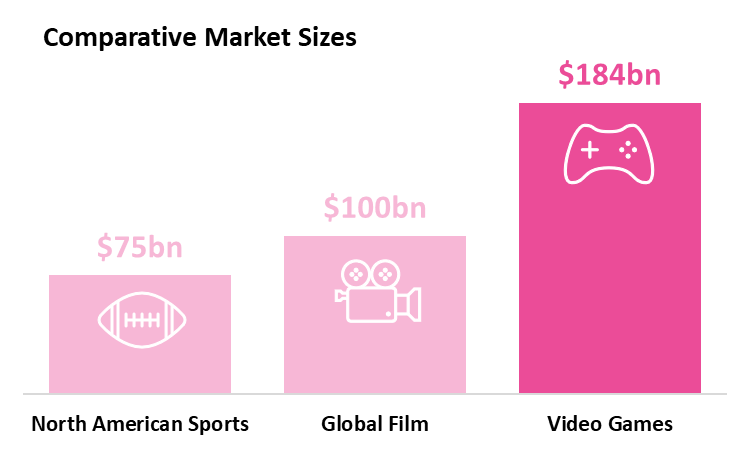

Over the past two decades, the size of the video gaming industry has swelled from what was once a $22 billion industry in 2002 centered around single-purchase, console-based games into a $184 billion multi-platform market with a host of parties (publishers, platforms, and studios) vying for consumer attention. The COVID-19 pandemic only accelerated this growth as consumers turned to gaming for social interaction and a sense of community – since 2020, audiences on Twitch have watched over 60 billion hours of content.

Source: MarketWatch

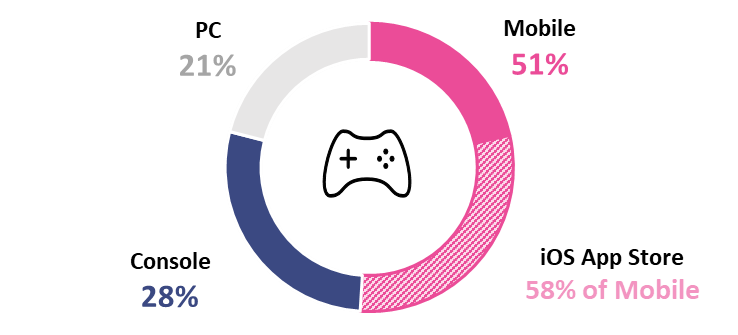

Mobile games have played a pivotal role in expanding this ecosystem. Since the introduction of the iPhone in 2007, mobile games have risen to now account for more than half of the gaming industry’s revenues. The proliferation of smartphones, particularly in Asia, has allowed game developers and publishers to bypass the traditional console and hardware model, making games more readily accessible by placing them directly into the pockets of users without the need for specialized gaming hardware.

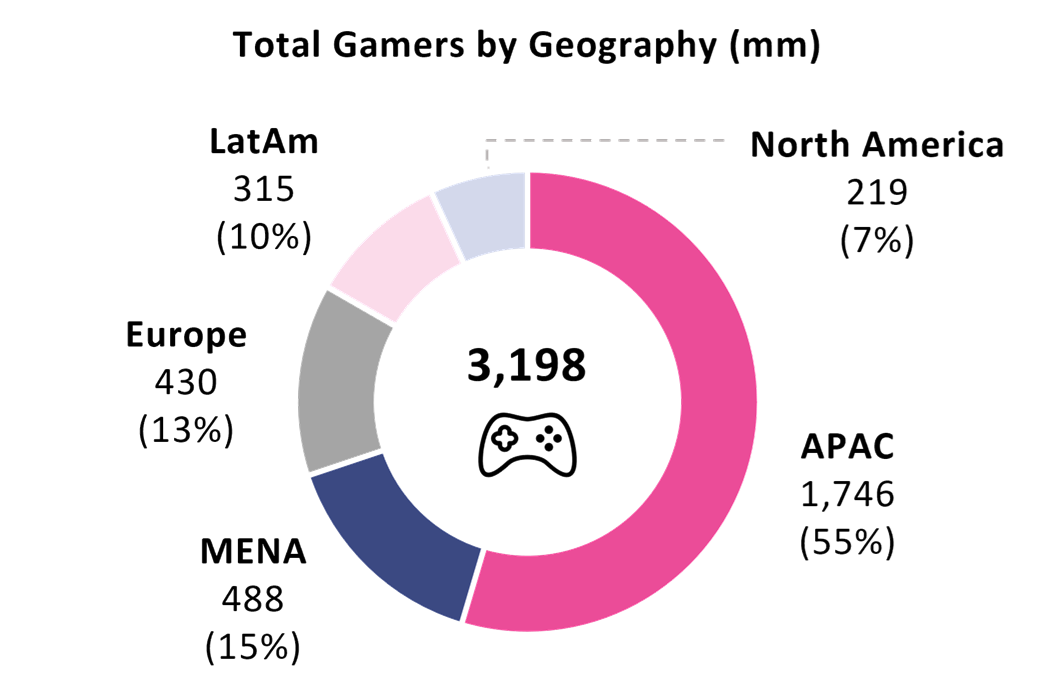

Additionally, contrary to common assumptions, the gaming population is not limited to just teenagers or young adults. The average age of a gamer is 35 years old, and they spend an average of more than six hours per week gaming. Given these facts, it stands to reason that individuals with real purchasing power are heavily engaged across the gaming ecosystem, dedicating nearly an hour each day to their preferred gaming experiences. Viewed collectively, the gaming community encompasses nearly all age groups and financial profiles, with an estimated 3.2 billion gamers worldwide.

The Next Level: It’s A-Me Fintech!

Point72 Ventures is aiming to underwrite the future of finance and support companies and products that we think will be instrumental in how people move and spend money. To understand the fundamental issues and recurring problems, we take a research-based approach, with our network being an integral part of this process. We look to build real relationships with a broad and deep array of industry experts across banks, merchants, payments businesses, vertical software players and more. We make an effort to learn about their pain points and priorities at the source and then attempt to find innovative solutions to their problems.

Based on our conversations with our network, we see financial technology as truly horizontal, impacting nearly every vertical as businesses monetize. We believe every business needs to consider access, distribution, or manufacturing of financial products, and that gaming is a perfect example of this. We believe payments and gaming have always been connected – from inserting a coin to play at the local arcade, to paying cash for console gaming cartridges (Mortal Kombat for our Sega Genesis was a Point72 Ventures’ team favorite!) at brick-and-mortar game stores, to buying a skin for a MMORPG character.

However, while the gaming industry has made many leaps over the last two decades, we think the financial infrastructure attached to it has not kept pace. Despite the lack of financial innovation, millions of dollars continue to flow through the global gaming industry every day. We believe this presents an opportunity for technology to facilitate, accelerate and improve the status quo.

In our view, recent economic and regulatory headwinds (e.g., the Digital Markets Act in the European Union, Apple vs. Epic Games, etc.) are only accelerating this trend and there are early signs of financial institutions and gaming platforms working together.

Here are 3 key areas of opportunity that we’re most excited about:

- Interoperability of content, payments and virtual currencies.

Historically, game developers built walls around their games to capture and retain consumer attention for as long as possible (e.g., single purchase titles, exclusive content libraries, etc.). But what if that is starting to change?

Many individual games utilize in-game virtual currencies, but according to conversations with gaming publishers in our network, many players wind up hoarding instead of spending those currencies. We think increasing virtual currency spending velocity is key to monetization. An analogue would be credit card points – card networks give us a way to cash out our points on travel, retail, restaurants, or entertainment, but gaming mostly does not offer the same options yet. Would allowing consumers to move virtual currencies to new versions of the same game, or to other adjacent games compel them to spend more? This is what we mean by ‘interoperability.’ If such currency interoperability across games is indeed the future, we think it will require additional infrastructure and tools alignment (e.g., fraud prevention, licensing management, value calculation / exchanges, dynamic ledgers, money transmitter licenses, etc.). Today, those capabilities aren’t widely available, and we think getting there would require industry-wide agreements that consider regulatory and economic challenges among other hurdles. Certain publishers are starting to produce games that share universes, and virtual economies are becoming increasingly embedded in games. Although we are still in early innings, we believe that this is the direction the gaming world is headed and that getting the financial infrastructure on the back-end right will play a pivotal role in the future.

- Enhanced global payments connectivity and fraud and compliance capabilities.

As gaming expands globally outside of markets like the U.S. and the U.K. where payments infrastructure is well-established, we believe emerging markets’ payments acceptance and digital wallet connectivity is a current challenge that the industry must meet. For example, in developing markets like Indonesia, payment methods like GoPay wallets may be more common than traditional credit or debit cards, and accepting and processing those transactions can present more complexity.

To reach more consumers, we believe gaming platforms will need to offer increased connectivity between the numerous payment methods and processors globally. To do that, these platforms will also need to have enhanced payments intelligence that can help them manage pain points around fraud, false declines, KYC, acceptance, and cost optimization. If successful, these platforms could unlock access to new consumers, resulting in increased payments volume and, ultimately, more revenue. For example, our portfolio company, Pagos, has already begun working with some gaming platforms who needed help understanding and analyzing their fragmented and unstructured global payments data. Pagos aims to surface structured payments data that those customers can analyze to derive actionable insights to improve their payments performance and ultimately improve their operations.

We believe there are meaningful opportunities for third-party “fintech-as-a-service” solutions to help gaming platforms and publishers to tackle payments, fraud prevention, and compliance, freeing them up so they can focus on building and distributing world-class games.

- Gaming studios are increasingly focused on distribution, monetization and in turn true ownership of their games.

Frustration from mobile gaming participants with traditional app stores continues to mount, as shown through the persistent agitation from publishers and studios with the over-reliance on existing distribution channels (e.g., Epic Games’ lawsuit against Apple) and the high tolls levied on transactions that flow through their systems. We believe publishers and studios are realizing that they can not only preserve meaningful margin but also unlock additional revenue by being able to control the distribution, back-end infrastructure, and monetization mechanics for their own games. While the distribution platforms will continue to fight this trend, we see increasing appetite to explore options that help publishers and studios own more of the consumer relationship and economics. We believe new and large businesses will be built around this space by teams with strong fintech and gaming backgrounds.