Demo Day: Five Tips for Founders

By Tara Stokes

Setting the Stage

Startup accelerators such as Y Combinator, Techstars or Entrepreneur First can be an extremely valuable resource for early-stage teams looking for capital, mentorship, network and playbooks from the people who have been there before.

At Point72 Ventures, we have partnered with many founders who have successfully completed these programs and gone on to build exciting companies. For example, we’ve invested in Y Combinator grads including Atomic Industries, Dashworks, Felix Biotechnology, Fieldguide, Focal Systems, Homebreeze, Stoke Space and Unbabel.

The end of these programs is often marked by the so-called Demo or Pitch Day, where start–ups present their products to an audience full of potential customers and investors.

The weeks leading up to these final presentations are equal parts exciting and nerve-racking. Below are some tips founders may want to consider when preparing for initial investor meetings.

1. No Pressure, no Diamonds

Congratulations! Preparing for this moment means you’re here! A Demo Day is the result of a lot of courage and innovation. As a founder, you will be asked to synthesize months of hard work into a short pitch. Practically, teams often pitch their startup as [TechCo] for [New Market] to efficiently communicate their mission and spark investor interest. For example, Uber for Mars or Stripe for Dinosaur Breeders.

Tip: “[TechCo] for [New Market]” is just an initial hook. Prepare to sell investors on your larger vision (and thereby potentially expand the TAM) during subsequent 1:1 conversations. Furthermore, pitch investors on your Founder-Market fit. Why are you (or your team) the person to win this market?

2. Divide and Conquer

These 1:1 conversations often occur around the Demo or Pitch Day, and your team’s time is valuable. Stay organized with an investor tracker and be disciplined when managing your teammates’ time.

Tip: We love meeting founders – but we don’t need to talk to every co-founder on the initial call. A 30-minute meeting is 30 minutes of your time, unless you also invite your co-founder to join (60 minutes of your team’s time) or two of your co-founders (90 minutes).

3. Be Specific to be Terrific

There is one question that you should knock out of the park, “How much are you looking to raise?”

Tip: Be prepared to answer how you will use the $X raise, and to provide the key milestones you intend to achieve with that capital to ensure a successful next raise. Even better, be prepared for the follow-up, “what would $X+Y do for you?” Be specific, numbers instill confidence. For example: “It allows me to hire A and B six months sooner, which will accelerate the launch of our beta by 3 months.”

4. Do Your Homework

Taking a step back, you’ll need to know whether you’d prefer a round size of $X or $X+Y. Evaluate both, and remember that a larger round size has consequences.

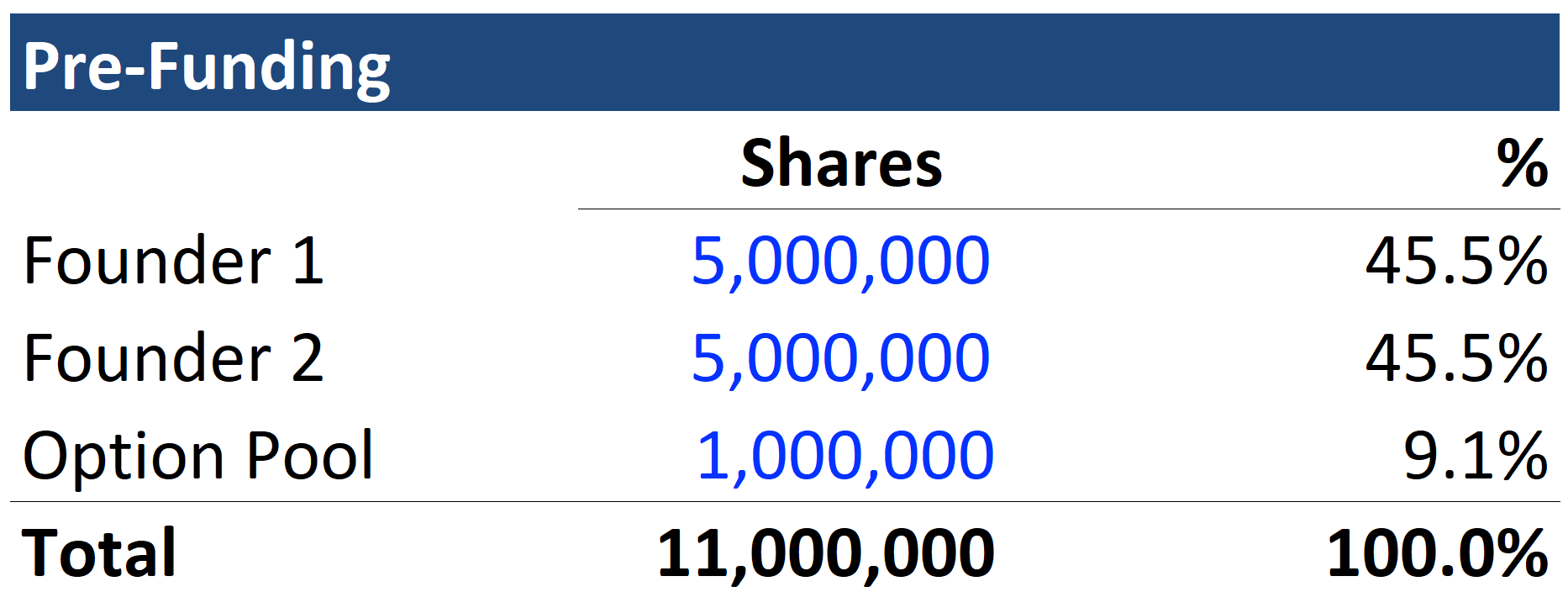

Tip: Build an excel worksheet to understand the consequences of round size and valuation on dilution. For illustration, assume the following 50/50 split among co-founders and an option pool to hire and retain the best talent:

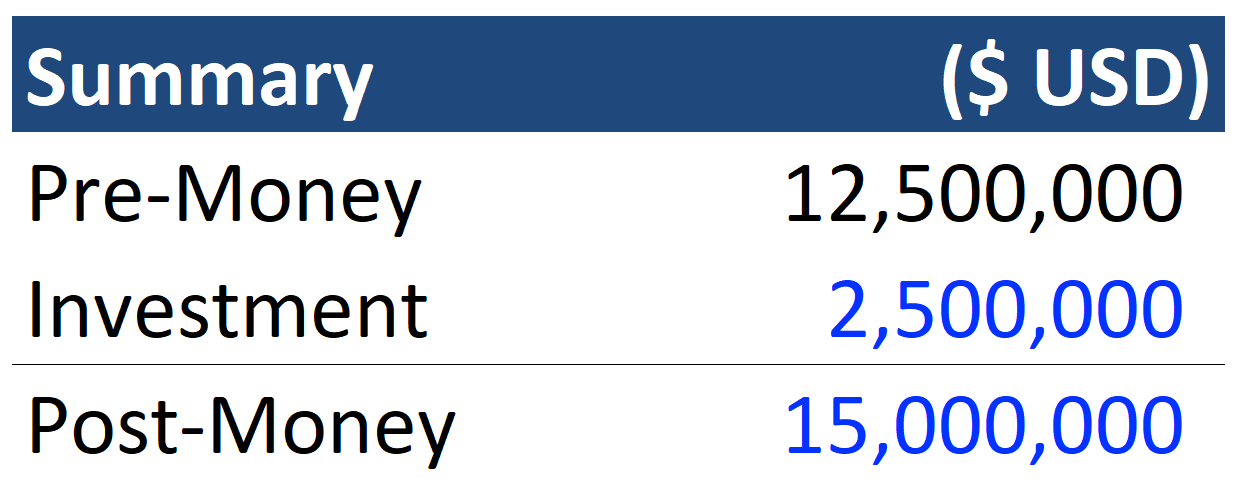

To keep numbers simple, let’s also assume the below round dynamics:

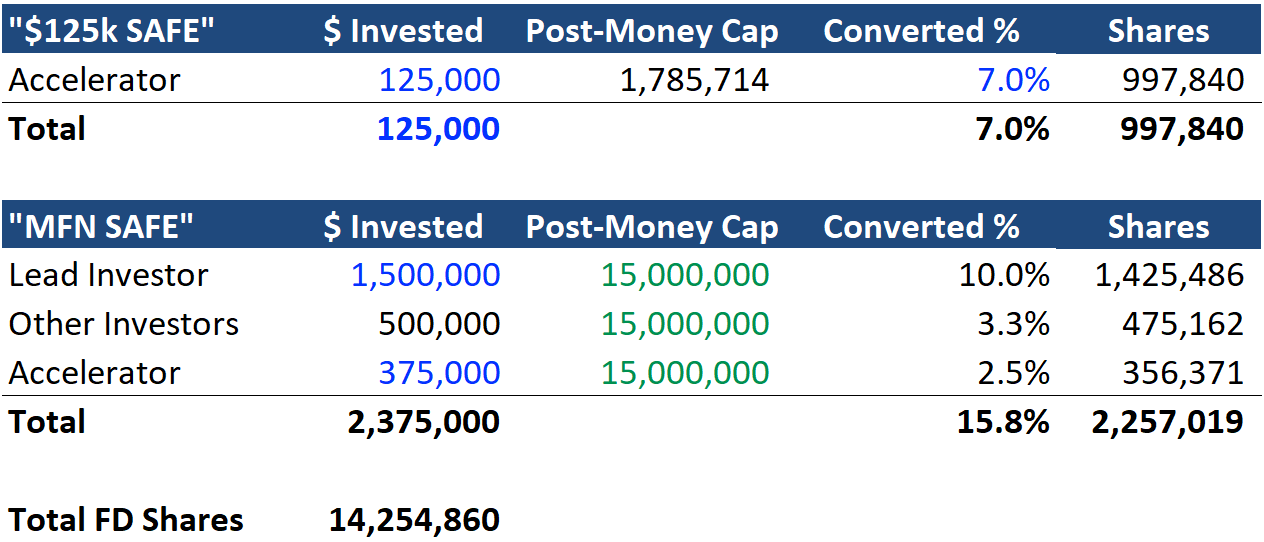

We can also assume an accelerator may make 2 separate SAFE investments (“Simple Agreement for Future Equity”, more here) totaling $500k:

- “$125k SAFE” – $125k on a post-money SAFE in return for 7% of your company

- “MFN SAFE” – $375k on an uncapped SAFE with an MFN provision (“Most Favored Nation”; i.e., the best terms issued)

Painting with broad strokes, you may arrive at the following investment makeup:

Tip: Calculate Total FD Shares as =IFERROR(“pre-funding total shares”/(1-“total converted %”),1)

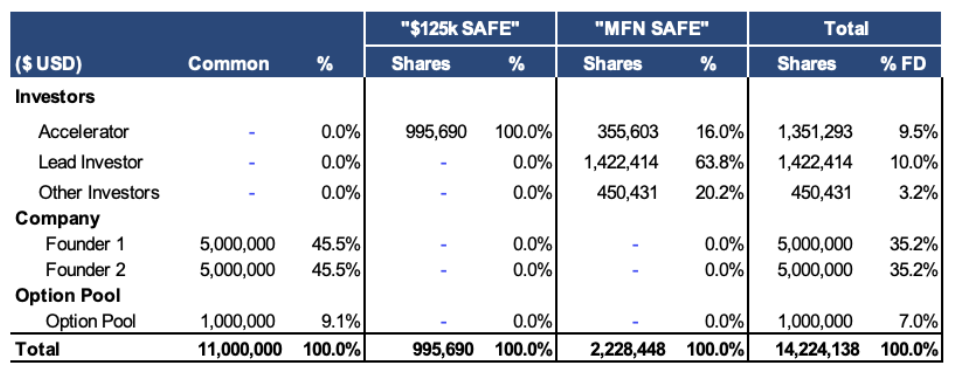

These SAFEs won’t convert until a priced round. At which time, there may be terms that impact the final outcome (ex. option pool increase), but the below is a ballpark estimate:

5. Know Your Audience

This fundraise is just the beginning of your journey! Negotiations can be an excellent way to continue building trust and rapport with a new investor at the table.

Tip: Understand how the levers you have as a founder (round size, valuation, option pool, etc.) can be used towards your ultimate aim (capital raised, valuation, dilution, etc.), and also try to understand your lead investor’s objectives (check size, ownership, valuation, etc.).

In the illustrative scenario outlined above, the lead investor may have been solving for a minimum ownership stake of 10% with their $1.5M check – consequently, there was less than $500k available for other investors to participate. By toggling scenarios in advance, you’ll be able to prioritize conversations and ideally solve for a win-win outcome with prospective investors.

Let’s Talk

We’re here to help founders on their journeys. Get in touch if we can be helpful as you prepare for pitch days. We fiercely believe in doing our part to foster a more diverse and inclusive start-up ecosystem for everyone.