Navigating the DoD budget cycle: End-of-year funds present opportunity for Defense Tech startups

It’s hard to build a business focused on selling to the government. Really hard.

Whether it’s navigating the multiple stakeholders necessary to make a government sale, long contracting cycles, budgets that get caught in political crossfire – there is no shortage of challenges facing the startups we see and work within the Defense Tech space.

But we believe that savvy founders can help accelerate their growth and sidestep the hurdles that typically slow Defense Tech growth by tapping into the fiscal year-end frenzy caused by the DoD’s “Use it or Lose it” budget phenomenon, in which organizations scramble to spend their unused budget to justify greater allocations in the following year. The real effects of the frenzy are clear. In the last week of the 2017 Fiscal Year, the DoD spent $23 billion on contracts – four times the average amount of any other week.

First, some context: The DoD budgets (and Congress authorizes and appropriates) approximately $850 billion annually divided across major categories or “colors of money” including Operation and Maintenance (O&M); Research, Development, Test, and Evaluation (RDT&E); Procurement; Military Construction (MilCon); and Military Personnel (MilPers). Funds earmarked toward these categories and the individual programs within are “obligated” or committed throughout the fiscal year for different contracts that fall within each color of money. Budgeted funds that are not obligated within a specific period (usually one or two fiscal years) will expire.

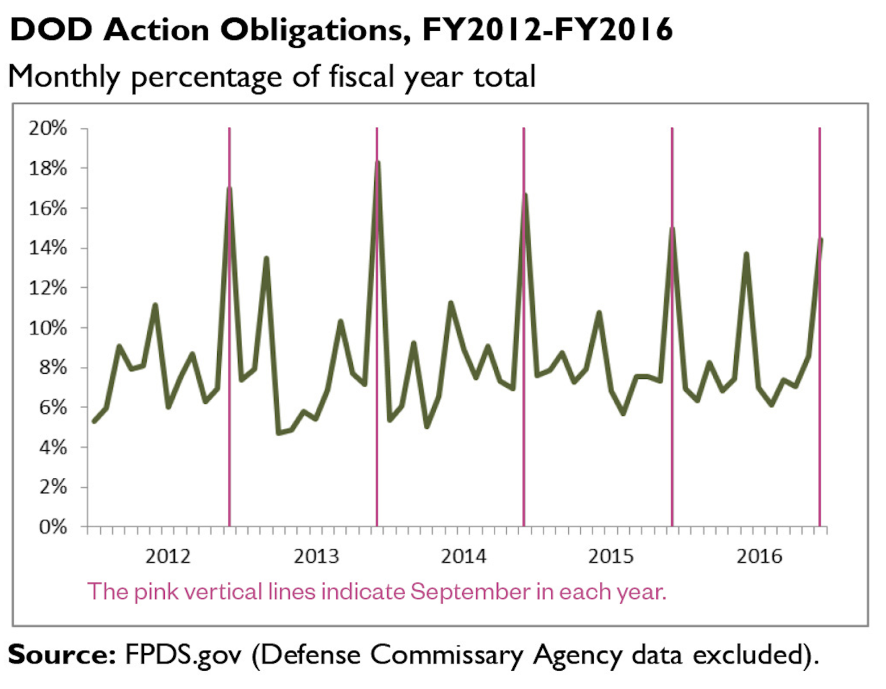

The DoD’s spend rate is far from consistent across a given fiscal year – obligations typically spike in September, the last month of the fiscal year, as contracting officers rush to commit remaining funds before they are set to expire.

In our view, these funds present a crucial opportunity for Defense Tech startups, because a relatively small reallocation for DoD, anything under the $10 million threshold that requires Congressional approval, can provide a Defense Tech startup with a critical middle-ground of funding that can help bridge early-stage R&D grants and hard to secure Programs of Record. These allocations can help startups to capture revenue quickly, accelerate their growth, and demonstrate their ability to earn market share to investors.

The challenge lies in being prepared to capture end-of-year funds effectively. We suggest Defense Tech startups initiate conversations and establish trust with Program Managers early on, showcasing the startup’s capabilities and demonstrating their value proposition to end users so that when it comes time to move money from under-obligated programs, it’s a clear choice. We believe that March, the halfway point of the DoD’s fiscal year, when obligation rates can be meaningfully evaluated, is the critical moment for startups to position themselves to be ready when end of year funds become available.

While this strategy can be a critical source for immediate revenue, it is also important for companies to focus on how contracts obtained in the fiscal year-end rush can act as a map towards more stable and long-term opportunities for recurring revenue. We believe diversification of revenue streams and a solid pipeline of opportunities beyond end of year spending is a must, otherwise startups risk turning these awards into one-off events.

Seeking to leverage the DoD’s “Use it or Lose it” budgetary mindset at the end of a fiscal year can be a key driver of growth for Defense Tech startups. By capitalizing on end–of–year funds, we think Defense Tech startups can avoid one of the most vexing challenges that plagues the Defense Tech industry and access a lifeline of flexible funding that allows them to deliver their critical technologies to warfighters.