Sri Chandrasekar is the Managing Partner of Point72 Private Investments, the private investing business of Point72 Asset Management.

Sri joined Point72 from In-Q-Tel, the strategic investment arm of the CIA and the U.S. Intelligence Community. At In-Q-Tel, Sri led investments and built research teams to solve some of the intelligence community’s toughest problems. Prior to In-Q-Tel, Sri spent nearly a decade designing and building systems for the military at BAE Systems.

I think AI will be responsible for a second Industrial Revolution.

It’s going to increase efficiency for knowledge workers the way steam engines did for factory workers. I get excited about the potential of the technology to change dozens of industries and the way people interact with their jobs.

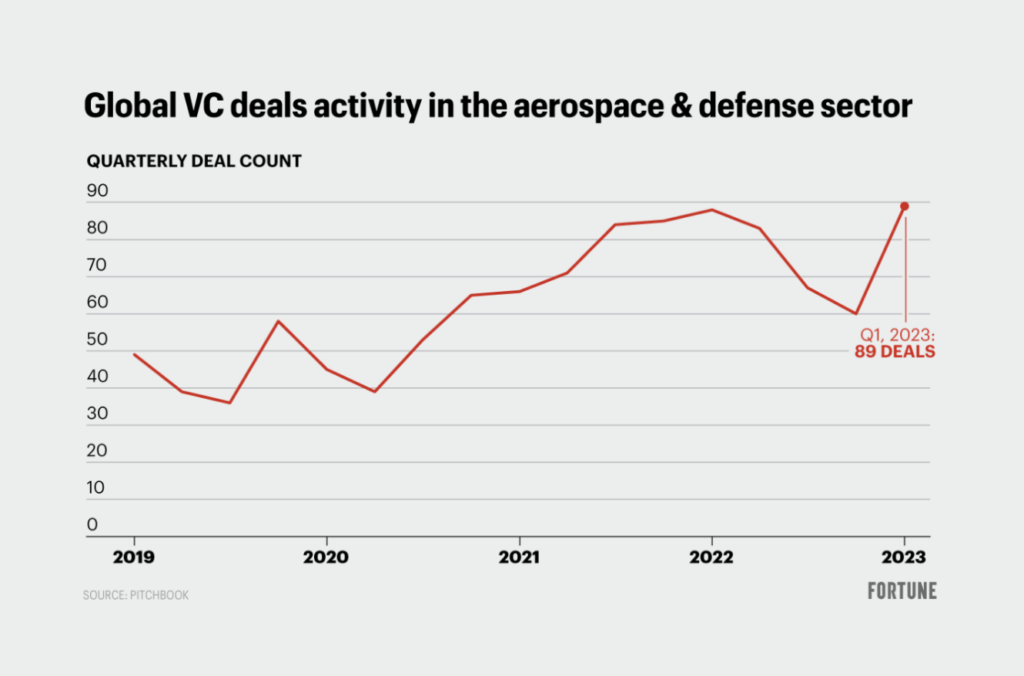

I believe the next decade will see the U.S. government become an important customer for venture backed startups.

Historically, a tiny fraction of the technology spend of the government has gone to venture backed startups. This is starting to change and founders who know how to sell to this customer – the largest technology buyer in the world – could likely find themselves growing faster and more sustainably than those who don’t understand the government sales process.

Talking to people is the most important part of my research process.

I find that I learn a lot more in a 30–minute conversation than I can in weeks of reading. You get context and expertise you don’t get anywhere else.

Learning is something that I never get tired of.

Being a VC is the ultimate career opportunity for me. It requires you to remain intellectually agile and enables you to constantly learn. I love hearing about new industries and ideas, and going down the rabbit hole of conversations, reading, and video watching that follows as I try to learn more.

Small talk cheat sheet:

NBA Basketball (Go Cavs!), home coffee roasting, old world wine, deeply-researched gym equipment.

Perspectives

October 28th, 2024

Clunky copilot or benevolent boss? Why I believe AI should prompt us

December 14th, 2023

Testing Built for AI Software: Our Investment in Distributional

October 24th, 2023

Making Cultural Values Stick – A Guide for Start-Up Founders

February 12th, 2021

Financially Empowering the Growing Non-Traditional Workforce

Press Coverage

This blog post is not an advertisement nor an offer to sell nor a solicitation of an offer to invest in any entity or other investment vehicle and has been published for informational and market commentary purposes. The information herein is not intended to be used as a guide to investing or as a source of any specific investment recommendation, and it makes no implied or express recommendation concerning the suitability of an investment for any particular investor. Neither Point72 Private Investments, LLC nor any of its affiliates (collectively, “Point72”) accepts any liability for such information’s fairness, correctness, accuracy, reasonableness or completeness—no reliance should be placed on this document or the information contained herein. Point72 is under no obligation to update this document or to otherwise notify a reader if any matter stated statement or information contained here changes or subsequently is shown to be inaccurate. The opinions, projections and other forward-looking statements are based on assumptions that the authors’ believe to be reasonable but are subject to a wide range of risks and uncertainties, and, therefore, actual outcomes and future events may differ materially from those expressed or implied by such statements. Investment strategies, such as those discussed herein, contain inherent risks and limitations, including that such investments may be subject to unfavorable competitive dynamics or that the methods described herein may not be successful in achieving investment objectives. All investments carry a risk of loss.