By Ben Shor

Over the past few years, we’ve observed consumer health evolve from a niche category into something that feels fundamental. It’s no longer just “wellness” on the fringe—it’s a $6.3 trillion global economy, including a $2.2 trillion U.S. market. And from what we’re seeing, it’s still expanding, driven by changing consumer expectations and increasingly accessible technology.

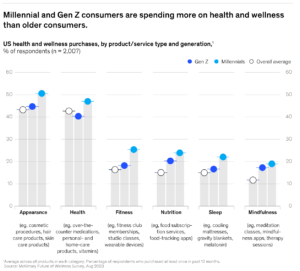

What we might have once thought was reactive and physician-led now appears to be proactive and consumer-directed. Supplements, wearables, diagnostics and treatments that were once considered luxury goods or niche tools are seemingly commonplace. I’m seeing today’s consumers increasingly prioritize solutions that help them feel better, look better and live longer—and that they’re willing to invest in what works. Even, it turns out, in a down market.

So where are we today? I’d describe this as a pivotal moment: one where foundational consumer behaviors are colliding with emerging tech to redefine what “health” means on a personal level.

The Shifts We’re Watching Closely

Several converging factors are changing the shape of how we think about the consumer health landscape. Some dynamics we find particularly compelling:

1. The GLP-1 Effect

The rise of GLP-1s (Ozempic, Wegovy, Mounjaro) has been a cultural and clinical tipping point, with 1 in 8 U.S. adults using these medications in 2024. I see this as an indicator that when a solution is both effective and relatively frictionless, adoption can often follow. More broadly, this may also be a signal on how demand is shifting across adjacent categories, which are now being re-evaluated through this new lens.

Some surgeons report that about 20% of their new cosmetic patients are GLP-1 users, often interested in skin tightening after rapid weight loss. In the food and beverage sector, households with GLP-1 users have cut their grocery and dining spend by about 6% and demand has shifted toward more “functional” nutrition such as high-protein snacks and low-sugar options. Users are also looking for ways to preserve muscle mass, fueling demand for protein supplements, strength training and recovery services. Finally, a growing number of wellness platforms are integrating GLP-1 programs, signaling that clinical interventions are becoming part of mainstream consumer health.

2. Information Overload

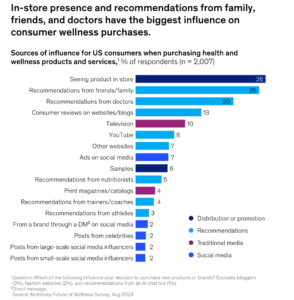

Social media is a powerful discovery engine, with 39% of consumers buying wellness products from influencer recommendations. But this can also increase information overload and misinformation. Just one recent, personal example: I searched for a specific recovery tool for an ankle injury and was suddenly served over 20 related products across each of my social media accounts. Meanwhile, it feels like a single health-related TikTok trend can go viral overnight with users contributing their own takes, regardless of their credentials.

3. From Manual to Passive Tracking

Nearly 1 in 3 Americans now use a health-tracking device, and we’re seeing a shift from manual logging of meals, workouts and sleep toward continuous, automated data capture. I think one of the most exciting shifts in consumer health is how passive tracking has become. With wearables, at-home diagnostic, and AI-powered platforms, people no longer have to log every meal or workout manually. The data flows from the wearable. I’ve explored some platforms that offer over 100 biomarker panels, which to me signals how much deeper consumer curiosity is getting. And with daily feedback from continuous monitoring, health insights are becoming more immediate, more personal, and from my perspective, more useful than ever before.

In parallel, interoperability standards such as Apple HealthKit, Google Health Connect and FHIR APIs are enabling fitness, lab and nutrition data to flow between platforms. Together, we see these shifts pointing to a consumer health experience that is becoming more connected, automated and personalized.

4. Aesthetics and Measurable Outcomes Matter

In my view, visible and tangible progress is one of the most underrated motivators in consumer health. Whether it’s clearer skin, improved body composition, or better sleep metrics, I think people are simply more likely to stick with routines when they can see that something is working. It’s not vanity — it’s basic psychology. Measurable results tend to reinforce behavior, and in a world flooded with wellness choices, outcomes are often what make something worth continuing.

Studies suggest that appearance-linked confidence can motivate consistent health behaviors like gym attendance and following dietary plans. The key, we believe, is blending functional health with aesthetic results for improvements that are both seen and felt.

Where We See Opportunities for Founders

As a team, we’re actively thinking about how companies can best serve this evolving consumer. Some of the areas we’re particularly excited about include:

Building Around GLP-1 Ripple Effects

As more people experience weight loss, we expect to see continued demand across the categories mentioned above: skin tightening and cosmetic procedures, muscle preservation and performance, high-protein snacks and supplements. We believe the winners won’t just be the drugs themselves, but the ecosystem builders—the products and services that help consumers navigate new bodies, new routines and new needs.

Trusted Distribution Models

In-app shopping features make it easier than ever to buy products without leaving your social platform of choice. Just one example: 43.8% of TikTok users made a purchase from the platform’s shop in 2024 and 79.3% of TikTok Shop sales in the U.S. are health and beauty products.

Meanwhile, a single trend like #GutHealth on TikTok can generate billions of views in a matter of weeks. But the same dynamics that drive discovery can also accelerate misinformation. In this environment, trust is a critical factor: 52% of US adults and 77% of Gen Z use social media as a trusted source for beauty and personal care information. Surveys indicate that more than half of consumers consider recommendations from health experts to be their most reliable source when making wellness purchases. This suggests an opportunity for platforms that help reduce noise by guiding consumers toward evidence-backed solutions, and for models that enable practitioners and experts to play a larger role in the consumer discovery process.

Simplification through Integration

To me, one of the biggest pain points in consumer health right now is just how fragmented the ecosystem still is. You’ve got wearables over here, supplements over there, diagnostics in one portal, coaching in another. Consumers I’ve spoken to end up juggling multiple apps, devices, and dashboards with no single source of truth. It’s not for lack of innovation, it’s just that none of it talks to each other. From our perspective, the most defensible solutions will likely be those that lower friction and create continuity across different aspects of the health journey, reducing cognitive load and making the experience feel integrated, not scattered.

Diagnostics as a Consumer Product

I think one of the subtle-but-important shifts in consumer health is how diagnostics have moved beyond the doctor’s office. What used to be physician-gated can now be a direct-to-consumer experience—accessible, even aspirational. We’re seeing lab tests rebranded into tools for self-optimization, tapping into what I’d call “health curiosity” as a cultural norm. But here’s our perspective on the catch: We believe that data alone isn’t enough. Without utility—coaching, guided behavior, personalized insights—it’s likely just noise. In my view, the stickiest platforms are the ones that make diagnostics feel as habitual and actionable as checking your bank account or tracking your daily steps.

Behavioral Design

In my experience, access to health data is no longer the problem. It’s what people actually do with it that matters. Meaningful results are still hard to achieve, and long-term retention often hinges on whether a product becomes second nature. The best platforms I’ve seen don’t just deliver data but aim to create habits. Whether it’s visible progress tracking, social accountability or gamified streaks, these small design choices can make a huge difference. I’m also seeing community playing a big role. People stick with routines when they feel supported. Personally, I think the most effective consumer health experiences are the ones that blend behavioral science—like habit formation and motivation—with biology, translating metrics into something people can actually see and feel.

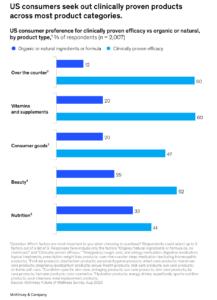

Clinical efficacy = differentiation

In my view, clean ingredients and transparency are just the starting point for today’s consumer, not the finish line. People are more discerning than ever when it comes to health and wellness purchases. Whether it’s a protein bar, supplement, device or diagnostic, they want evidence that it actually works. I’ve personally seen countless brands with strong marketing fail to get traction because they lacked scientific credibility. Especially in crowded categories like personal care and supplements, I believe that science-backed, proprietary innovation is no longer a nice-to-have, but table stakes. If you want to earn trust and stay relevant, proof seems to be more important than ever.

Our Lens as an Investment Team: Tangible Over Trendy

Despite the pace of innovation, we approach this space with a healthy dose of skepticism. It’s easy to get swept up in the excitement of new modalities or viral trends, but we try to focus on what sticks, not just what spikes.

That lens informs how we think about the broader category. We see consumer health as a combination of behaviors, technologies and motivations. Our perspective is rooted in a few core beliefs:

- We prioritize behavioral reinforcement. In our experience, companies that embed into existing routines tend to have more staying power than those that require full lifestyle overhauls.

- We value visibility. Progress that can be seen, felt, or measured is often a better driver of adherence than abstract goals.

- We assess trust. In an age of information overload, trust can be scarce. Whether through credentialed experts, peer recommendations or proof of efficacy, consumers are often seeking validation.

The consumer health and self care companies we’ve backed that reflect these themes:

- Mirror (acquired by Lululemon): A rethinking of in-home fitness that aimed to merge function with form—and showed that connected fitness could feel aspirational.

- Ladder: Fitness infrastructure that leverages accountability and habit loops to help drive stickiness.

- Bliss Aesthetics: Built to capture the new demand emerging from body transformation trends. Focused on accessibility, transparency and personalization.

- Natural Cycles: A science-backed, non-hormonal birth control app that allows users to monitor fertility through daily temperature tracking and personalized insights.

- Boulevard: Vertical software solution for med spa owners to create more personalized self-care experiences.

- Quantune: A non-invasive glucose monitoring platform using laser spectrometry.

What’s Next for the Category?

In the near future, I think we’ll see greater interoperability between data sources (think wearables, diagnostics and apps) combined with AI-powered guidance. That could lead to more personalized, responsive recommendations across nutrition, fitness, sleep and stress management.

Even with all the hype and tech cycles, I think our core health needs haven’t really changed. At the end of the day, most people just want to feel good, age well and remove friction from staying healthy. New tools come and go, but what seems to stick are the solutions that make those fundamentals easier to achieve. Ultimately, I believe the real test of an enduring consumer health startup isn’t whether the science sounds fancy, but whether consumers stick with it—and whether, when they look in the mirror, they find themselves feeling better and realizing they got there more easily than they expected.